Find the Right Finance Partner for Your Remodeling Business

Many contractors lose projects when homeowners lack access to the funds. The right home improvement finance partner can make all the difference, helping contractors close more projects, strengthen cash flow, and deliver a seamless customer experience.

For home improvement businesses, the difference between winning or losing a project often comes down to financing. Homeowners want flexible, transparent options that fit their budget, and contractors need a financing flow that supports quick approvals, fast payouts, and minimal friction.

By aligning with the right home improvement finance partner, companies can create a smoother sales process, increase customer confidence, and ultimately drive more revenue from every project.

What you will learn

- Why financing flows are critical for closing home improvement projects and improving cash flow.

- How to evaluate your business and customer needs when choosing a financing partner.

- The difference between single-lender setups and multi-lender platforms.

- Practical steps to decide which financing model best fits your business.

What is a Financing Flow?

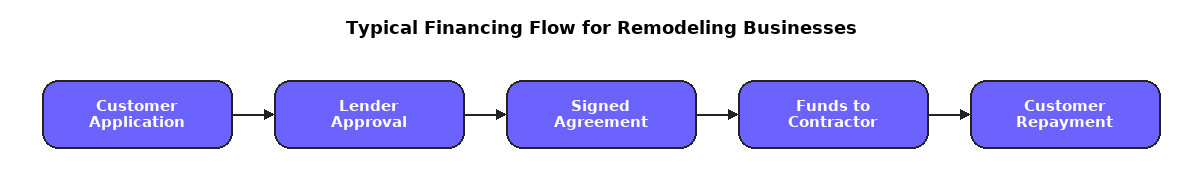

A financing flow is the step-by-step journey that takes a homeowner from application to approval and, ultimately, project completion. It begins when the customer submits a financing application, continues with lender review and approval, moves to funds transfer, and ends with the contractor delivering the finished project. A typical financing flow looks like this:

- The customer applies for financing during the consultation process. This is often in-home,, in an office, online, or in a store.

- The lender reviews the application and either approves or declines.

- Once approved, the homeowner signs the agreement and the contractor begins working on the project.

- After the project is completed, the lender disburses funds directly to the contractor, while the homeowner repays the lender over time.

For contractors, the quality of this flow makes all the difference. The process must be fast enough to provide instant approvals at the kitchen table, broad enough to cover a wide range of credit profiles, and simple enough that customers can apply in just a few clicks.

Understanding Business Needs

Choosing the right financing partner starts with understanding the unique needs of your home improvement business and your customers. Contractors need solutions that can adapt to the realities of projects, from covering varied job sizes to keeping cash flow predictable, while homeowners expect flexible, transparent, and convenient options. The right financing flow balances these priorities to deliver stronger outcomes for everyone.

Your Business Needs

- Project variety and flexibility – Home improvement jobs can range from quick repairs to six-figure renovations. A financing partner should be able to support this full range with flexible loan terms and amounts, without forcing contractors to manage multiple systems.

- Cash flow alignment – Some projects demand upfront payouts for materials and labor, while others work best with milestone-based draws. The financing model should align with how your business operates, ensuring you can take on jobs confidently.

- Operational simplicity – Contractors shouldn’t have to become financing experts. The best solutions consolidate approvals, payouts, and lender relationships into a single streamlined process, reducing admin work and letting teams focus on delivering projects.

Your Customer’s Needs

- Credit score flexibility – Every homeowner’s financial situation is different. By offering financing across the credit spectrum (prime, non-prime, and no-credit options), contractors can serve more customers and close more deals.

- No hidden fees, transparent terms – Customers want to trust their financing choice. Clear, upfront terms prevent surprises and build long-term confidence.

- Simple application process – A quick, customer-friendly application makes financing easy to accept during a consultation, reducing friction and helping contractors secure the project on the spot.

Evaluating Lender Features

The ideal partner combines industry expertise, strong approval coverage, modern technology, and hands-on support to ensure financing becomes a growth driver rather than an administrative burden. To evaluate potential effectively, it helps to break down these qualities:

- Multi-lender coverage across the credit spectrum for more approvals, fewer lost projects.

- Seamless integration built into sales flow.</li

- Operational simplicity. One application, one platform, all lenders; less admin, more sales.

- Scalability & partner enablement, with the flexibility to handle any project size, expand into new categories, and access resources to grow your business.

Types of Financing Options for Home Improvement Contractors

Contractors typically have two main ways to offer financing to customers: working with individual lenders or using a multi-lender financing platform. The difference comes down to choice, coverage, and ease of management.

Individual lender integrations

Some contractors work directly with one, two, three lenders or more. While this setup may feel familiar, it quickly becomes complex to manage. Each lender has its own application process, approval criteria, and payout terms. That means contractors spend time juggling systems, while customers face declines.

Multi-lender financing platforms

Instead of managing multiple lender relationships, contractors can connect to a financing platform that provides access to a broad network of lenders through a single integration. With one application, homeowners are automatically matched to the best-fit financing choices. Platforms may work in a waterfall model (where the system routes the application until approval is found) or as a marketplace (where customers can choose from multiple offers). ChargeAfter supports both models, giving contractors the flexibility to deliver financing in the way that best fits their business and their customers. This approach reduces complexity, boosts approval rates across the credit spectrum, and makes it easier to close more projects with less friction.

Quick Financing Flow Self-Assessment Checklist

Not sure which financing model fits your business? Use this checklist to guide your decision.

Project size range

Do you take on projects that may require financing?

Yes → Access to multiple lenders supports a wider range of loan sizes.

No → A single lender may be enough, though a platform keeps you flexible if needs change.

Customer credit profile

Do your customers span a broad range of credit scores?

Yes → A diverse lender network (prime, near-prime, subprime) increases approvals and close rates.

No → A direct lender could work if most customers have great credit, but a platform prepares you for shifts.

Financing flexibility

Do you want homeowners to compare financing offers side by side?

Yes → A marketplace model provides transparency and choice.

No → A waterfall model simplifies the process by auto-matching to the best-fit lender.

You can combine both!

Business growth plans

Do you expect to expand into larger or more frequent projects in the next few years?

Yes → A platform scales with your growth and changing customer mix.

No → A direct lender may suffice, though a platform keeps future options open.

With the right partner, financing becomes a growth engine.

How ChargeAfter Supports Home Improvement Businesses

With the right partner, financing becomes a growth engine. ChargeAfter combines industry expertise with technology to help contractors accomplish this by offering:

Maximum approval coverage through a multi-lender network

ChargeAfter connects contractors to a wide range of lenders, from prime to near-prime and subprime. That means more of your customers get approved, and fewer jobs are lost.

Seamless integration into your sales process

Financing is built directly into the sales funnel, whether you’re at the kitchen table, in a showroom, or selling online. One application returns instant approvals, making it easy to offer financing at the moment of decision.

Actionable analytics and insights

A financing program shouldn’t just process applications — it should help you understand your business better. ChargeAfter equips contractors with detailed analytics on approval rates, lender performance, and customer behavior.

Conclusion

Too often, homeowners want to move forward with home improvement projects but lack immediate funds, leaving contractors with stalled sales and inconsistent cash flow.

A well-designed financing flow solves this problem. By making it easy for homeowners to apply, secure approvals across diverse credit profiles, contractors can turn financing into a growth driver instead of an administrative burden.

That’s where ChargeAfter comes in. With a multi-lender network that maximizes approval coverage, seamless integration, and end-to-end management, ChargeAfter provides everything home improvement businesses need to win more jobs and grow profitably.

Financing doesn’t just support your projects, it fuels your business. And with ChargeAfter as your partner, you can deliver the flexible, transparent options homeowners want while creating the reliable cash flow and sales growth your business deserves.

Key Takeaways

- A homeowners ability to secure financing often decides whether home improvement projects move forward or stall.

- A strong financing flow reduces friction: instant approvals, transparent terms, and reliable payouts.

- Contractors benefit most from multi-lender platforms, which increase approval coverage across diverse credit profiles and project sizes.

- Simplicity matters. Financing should integrate seamlessly into the sales process and be easy for both teams and customers to use.

- ChargeAfter combines a broad multi-lender network, POS integration, and analytics-driven insights to help contractors close more jobs and strengthen cash flow.

Final thoughts

Financing is no longer a back-office function, it’s a critical part of the sales conversation that can make or break a home improvement project. By choosing a partner that offers broad approval coverage, seamless integration, and clear insights, contractors can turn financing into a powerful growth engine. ChargeAfter brings all these elements together, helping contractors win more jobs and build lasting customer trust.

FAQ

A financing flow is the process that takes a homeowner from application to approval and funding. It covers every step: applying, lender review, approvals, payouts, and project completion, and shapes how seamless the customer experience feels.

Financing partners help contractors close more deals by making projects accessible for homeowners. They also make financing simple to offer and manage, reducing administrative work so contractors can focus on delivering projects.

A single lender offers one set of credit criteria and terms, which can lead to more customer declines. A multi-lender platform connects contractors to multiple lenders through one system, boosting approval rates and giving homeowners more options.