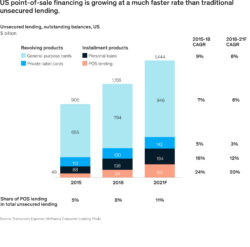

Over the past few years, many retailers have concentrated on direct-to-consumer and e-commerce. As part of this – specific consideration has been given to consumer financing, and significant agreements have been made between consumer finance FinTech companies and big-brand companies such as Walmart, United Airlines, Amazon, Lenovo, and many others, even though these retailers already have well-established private label credit card programs.

Consumer appetite for consumer financing and BNPL drives merchant demand for point-of-sale financing.

* https://www.oberlo.com/statistics/buy-now-pay-later-us-users

Beyond surveys, historical growth statistics, or forecasts for rising popularity in consumer finance, the evidence lies with two simple metrics:

— How many companies include consumer financing at their point of sale, and

— Are any big brand retailers are embracing it

The fact is, consumer financing has always been a staple with big retailers.

The difference in recent times is that big brands recognize the benefits of partnering with innovative FinTechs, allowing them to concentrate on their core business while benefiting from new technologies as they are developed.

Previously, this was exclusive to merchants with the resources to integrate or develop point-of-sale finance options into their platform.

Innovation by FinTechs has accelerated the adoption of consumer finance as demand by merchants is fueled by consumers’ need for affordability in the face of the current and imminent challenging financial environment.

It is essential to understand that consumer finance does not exclusively mean Buy Now Pay Later (BNPL), although BNPL does fall under the umbrella of consumer finance.

Evolution of consumer finance

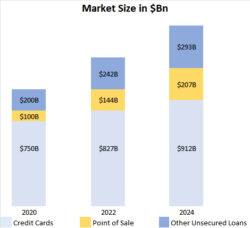

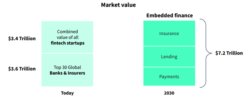

Consumer financing has evolved from credit cards and prime lending solutions often offered by traditional financial institutions such as banks to a technology-diverse fintech landscape with various financial service providers and platforms.

But what does this new ‘landscape’ offer, and how do we navigate it?

We look at how merchants use various consumer finance options and highlight their benefits.

Credit Card

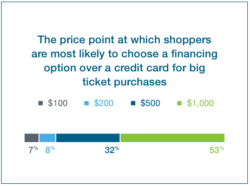

The credit card option at checkout is widely known to us. It is the most prevalent payment method. Almost all banks and financial institutions provide many credit card types that are accepted as payment methods offering goods or services anywhere. One can purchase anything within a predetermined credit limit and pay later without impacting their monthly budget. A key advantage of using a credit card is converting the total purchase amount into affordable equated monthly installments (EMI), facilitating easy repayment over time. EMI conversions from credit card purchases have transformed the shopping experience significantly.

As popular as credit cards have been, consumers know their glaring disadvantages. The most infamous being high-interest charges. Further, the prime lender provides the loan (credit). i.e., the institution that issued the credit card reduces the credit limit by an amount equal to the bill amount converted into EMIs.

Buy Now, Pay Later

Single Lender BNPL Platform

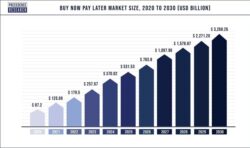

BNPL (Buy Now, Pay Later) is unsecured consumer credit and an increasingly popular fintech-enabled payment option, most commonly offered on e-commerce platforms. The history of BNPL traces back to the installment plan – a way to pay for large purchases over time by spreading it over several smaller payments.

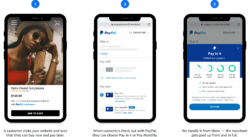

As a form of POS (point-of-sale) financing, credit originates directly at the time and point-of-sale, as opposed to a customer being required to secure credit from a lender ahead of their shopping experience.

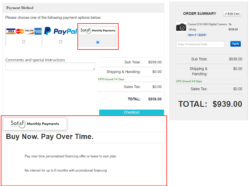

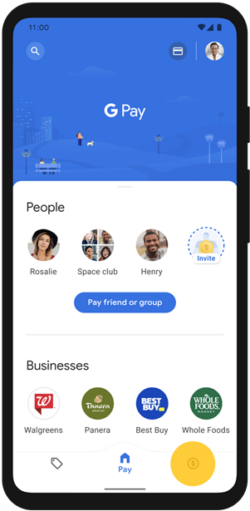

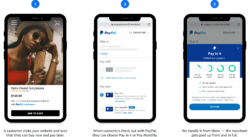

Fintech companies have developed different flavors of BNPL. However, most are similar in that they have a single lender. Sometimes, as with PayPal, the lender is also the technology provider.

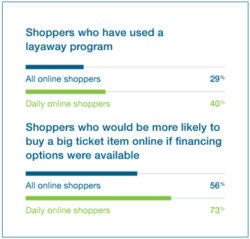

Studies have shown that BNPL increases retail sales. The reason is that some consumers may not have a credit card, prefer not to use credit cards, and many times look at BNPL as a better alternative to credit card installments, as BNPL offers an alternative to installment payments that is often with favorable repayment terms when compared to the use of credit cards.

Most, if not all, well-known big brands, such as Amazon, Walmart, and many more, have teamed up with BNPL FinTechs to expand their consumer financing options to increase sales while limiting risk. This strategy has proved to be successful.

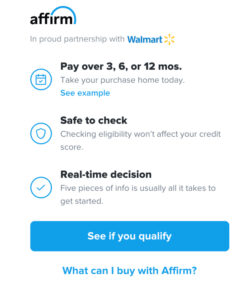

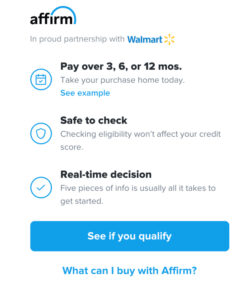

Walmart

Walmart is an American multinational retail corporation that operates a chain of hypermarkets, discount department stores, and grocery stores. With over 10,000 stores in 27 countries, Walmart offers a wide range of products, including groceries, electronics, clothing, and home goods, at low prices to attract budget-conscious shoppers. The company is known for its efficient supply chain management. Walmart added Affirm as a BNPL for installments of 3,6 and 12 months.

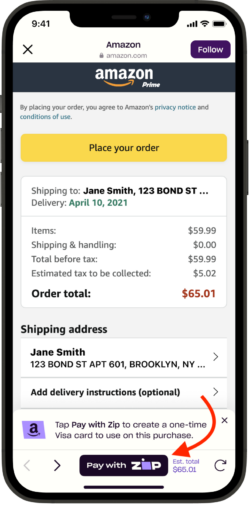

Amazon

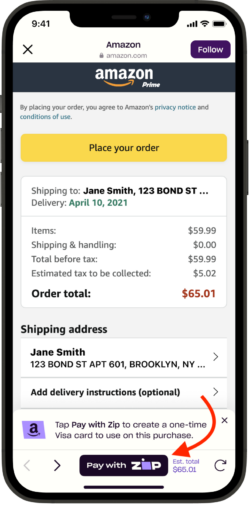

The largest retailer in the world and founded in 1994, Amazon is a multinational technology company. It specializes in e-commerce, cloud computing, digital streaming, and artificial intelligence.

In this example , Amazon has partnered with ZIP to offer short terms installments.

The problem with single-lender BNPL

However, although very convenient, single-lender BNPL platforms do not necessarily offer the consumer the best loan terms and are limited to BNPL only.

Customers must conform to single-lenders’ terms of service and credit score policy.

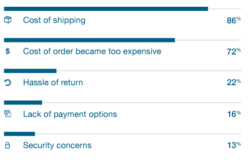

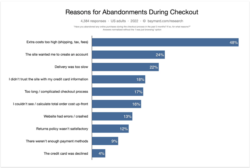

Imposing these terms of service may result in less than desired loan terms offered to the consumer or, even worse, a failed loan origination. Both scenarios heighten the probability of sale abandonment.

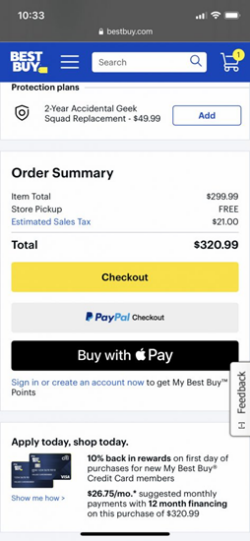

Big brands have recognized that consumers shop for the best deals, not only in products and services but also in costs and terms associated with financing their purchases.

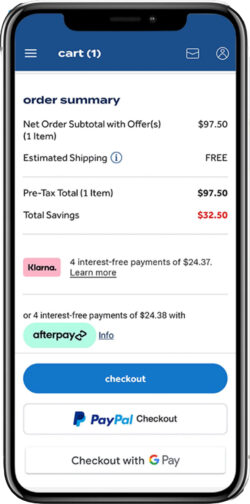

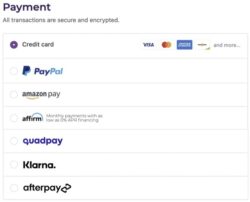

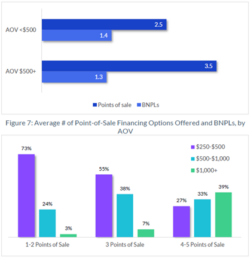

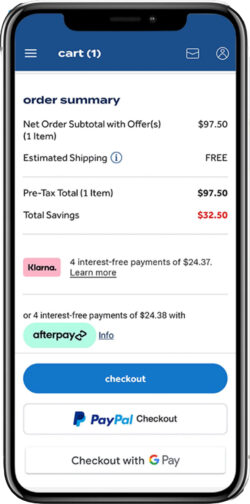

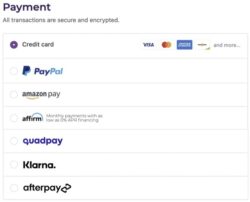

For this reason, established merchants offer customers multiple payment options at checkout. Including multiple BNPL service providers and options. Most of which are single-lender platforms.

Bed Bath & Beyond, for instance, diversifies its consumer financing options to its customers by partnering with multiple BNPL financing providers.

Merchants have found that sale abandonment decreased because customers have more options for lending at the point-of-sale. While this is a good strategy by the merchants, it has many limitations. For one, it is still a limited short-term installment offering. Even when using several BNPLs, surveys found that almost 30% of merchants report that their consumer financing approval rates are less than 60%.

Furthermore – it creates a fragmented checkout experience. Sometimes, customers may still abandon their cart, feeling overwhelmed, unsure, and confused with the various options. Decision paralysis occurs because there is too much choice.

A study by SMARTASSISTANT found that 54% of consumers have stopped purchasing products from a brand or retailer website because choosing was too difficult.

The same is true for products & services and checkout payment options alike.

Multi-lender Consumer finance & BNPL platforms

As a means to offer the advantages of the different types of consumer finance options available and address their shortcomings, ChargeAfter developed a multi-lender consumer finance embedded lending platform.

Backed by over 40 lenders, in a single checkout financing option, merchants can offer their customers the best consumer loan at checkout, which is lightning fast and provides the best loan terms.

ChargeAfter’s platform and network finds the best loan suited for the customer and merchant with a streamlined and efficient process that feels indigenous to the merchants’ site and brand.

Unlike conventional consumer finance options and single-lender BNPL, surveys have shown that multi-lender consumer finance platforms achieve loan approvals of 80% or more.

ChargeAfter’s platform is seamlessly integrated throughout the merchants’ channels – online and in-store – to create an omnichannel experience that feels proprietary to the consumer. The benefit of omnichannel experience in itself adds value to the merchant.

As a solution that maximizes return through its obsession with the customer journey experience, ChargeAfter’s platform elevates the consumer experience, reduces cart abandonment, and increases return business.

Some examples of big brands using a multi-lender platform include:

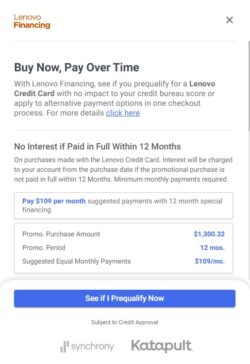

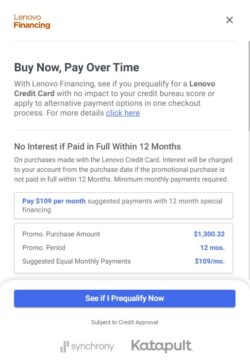

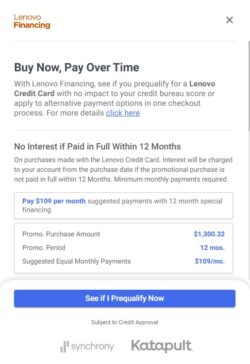

Lenovo

Founded in 1984 and specializing in personal computers, smartphones, tablets, and other electronic devices, Lenovo is the world’s largest PC vendor by unit sales.

Lenovo is a multinational technology company that operates in over 60 countries.

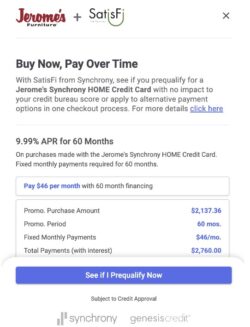

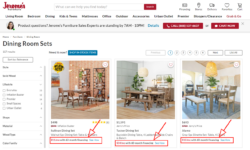

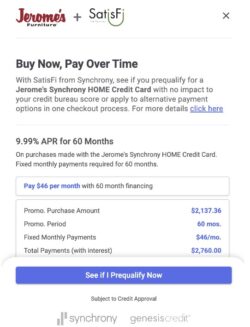

Jerome’s

Jerome’s Furniture is a family-owned and operated retailer that has been serving Southern California for over 65 years.

About ChargeAfter

ChargeAfter is the leading multi-lender white-labeled consumer financing platform and lender network for global banks, financial institutions, and merchants. Powered by a data-driven decision engine and network of international lenders, ChargeAfter streamlines the distribution of credit into a single platform that merchants can implement rapidly online, in-store, and across any point of the loan.

ChargeAfter investors include The Phoenix, Citi Ventures, Banco Bradesco, Visa, MUFG, BBVA, Synchrony Financial, PICO Venture Partners, Propel Venture Partners, and Plug and Play VC. ChargeAfter is headquartered in New York.

For more information, visit: https://chargeafter.com/about/.